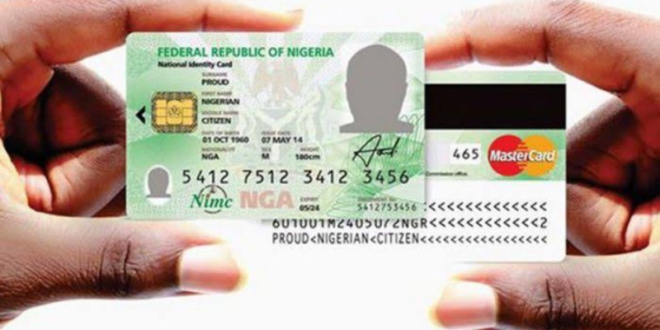

The Nigerian government, in collaboration with the National Identity Management Commission (NIMC), the Central Bank of Nigeria (CBN), and the Nigeria Inter-bank Settlement System (NIBSS), has announced the launch of a new multipurpose national identity card.

This innovative solution, powered by AfriGO, a national domestic card scheme, is set to drive growth and facilitate financial inclusion for all Nigerians.

The initiative aims to provide a comprehensive identity solution for Nigerian citizens and legal residents, equipped with payment capabilities for a wide range of social and financial services.

The national ID card, layered with verifiable national identity features, is backed by the NIMC Act No. 23 of 2007, which mandates the commission to enroll and issue a general multipurpose card (GMPC) to eligible individuals.

The card, designed to meet International Civil Aviation Organization (ICAO) standards, will serve as the country’s default national identity card.

It will enable cardholders to prove their identity, access government and private social services, and empower citizens, while also encouraging increased participation in nation-building.

Key features of the national ID card include:

Machine-readable zone (MRZ) that complies with ICAO standards for e-passport information.

Identity card issue date and document number, in line with ICAO standards.

Nigeria’s quick response code (NQR) containing the national identification number.

Biometric authentication, such as fingerprint and picture, for identity verification.

Offline capability for transactions in areas with limited network coverage or zero infrastructure connectivity.

Functionality as a debit and prepaid card catering to both banked and unbanked individuals.

Nigerians and legal residents with a national identification number (NIN) will be eligible to request the card, which will be produced according to ICAO standards to ensure the confidentiality and safety of users’ information.

This development marks a significant step in Nigeria’s efforts to promote financial inclusion, enhance access to social services, and empower its citizens.

By providing a comprehensive identity solution with payment capabilities, the FG aims to bridge the gap between the financially excluded and the broader financial ecosystem, fostering greater participation in the country’s economic growth.

Subscribe to the Advocate News letter and receive news updates daily in your inbox.

Advocate.ng Latest news update on politics, entertainment, sport and more

Advocate.ng Latest news update on politics, entertainment, sport and more