Nigeria’s electronic payment (e-Payment) transactions have experienced a remarkable surge in the first quarter of 2024, with a total value of N234 trillion, reflecting an impressive 89.3 percent increase from the N123.8 trillion recorded in the corresponding period of 2023.

This significant growth was reported by the Nigeria Inter-Bank Settlement System (NIBSS), highlighting the rapid expansion of digital financial services within the country.

In contrast, Point of Sale (POS) transactions witnessed a 7.92 percent downturn in the review period, dropping from N2.84 trillion in Q1 2023 to N2.61 trillion in the first quarter of this year.

Despite this decline, the overall e-Payment landscape demonstrated a strong preference for digital transactions among Nigerians.

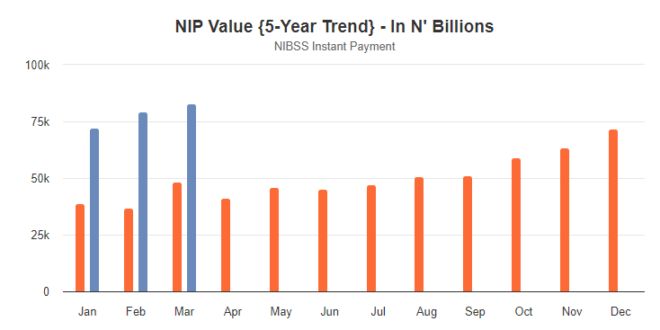

The month-on-month analysis of the e-Payment transactions for Q1 2024 revealed a consistent upward trend.

January saw transactions amounting to N72.11 trillion, followed by a surge to N79.33 trillion in February, and an additional increase to N83.05 trillion in March.

These figures indicate a sustained momentum in the adoption and utilization of e-Payment solutions in Nigeria.

Comparing the figures to the same period in 2023, the first quarter of 2023 saw electronic transactions valued at N38.8 trillion in January, N36.8 trillion in February, and N48.3 trillion in March, totaling N123.8 trillion.

The growth in 2024 highlights a significant shift towards greater digitalisation and efficiency in financial transactions within the country.

The data also revealed fluctuations in POS transactions throughout the first quarter of 2024.

January saw transactions amounting to N850.09 billion, followed by a slight decrease in February to N805.05 billion, and an increase in March to N961.86 billion.

The cumulative value of these transactions for the quarter amounted to N2.61 trillion.

As of April 2024, the total count of Bank Verification Number (BVN) enrolments reached 61,605,261 individuals, marking an uptick of 1,449,901 registrations over the span of four months, compared to the figure of 60,115,360 people recorded at the close of 2023.

The growing preference for e-Payment transactions in Nigeria signifies a significant digital transformation in the financial services sector.

The continued expansion and adoption of digital financial services are expected to drive further growth and innovation in the Nigerian economy.

Subscribe to the Advocate News letter and receive news updates daily in your inbox.

Advocate.ng Latest news update on politics, entertainment, sport and more

Advocate.ng Latest news update on politics, entertainment, sport and more