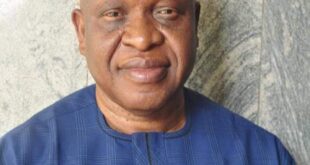

In a decisive move to reform Nigeria’s banking sector, the Governor of the Central Bank of Nigeria (CBN), Olayemi Cardoso, has announced a commitment to creating an aggressive regulatory environment aimed at curbing infractions within the country’s banking system.

Cardoso made this announcement at his first Monetary Policy Committee meeting since taking office in September 2023.

He revealed that an extensive investigation into banks involved in regulatory breaches is currently underway.

The development of “stringent regulations,” particularly aimed at overhauling the foreign exchange market, is also a priority to ensure its cleanliness and integrity.

In a bid to promote transparency and efficiency in the foreign exchange market, Cardoso shared positive news regarding the nation’s economic reserves.

As of February 20, Nigeria’s foreign reserves had climbed to $34 billion, marking a $2 billion increase from the $32.23 billion recorded at the end of January.

However, the Nigerian currency has experienced significant depreciation since the new administration’s decision to float the naira and merge exchange rate windows.

Cardoso assured that the CBN is transitioning towards a “very aggressive regulatory environment” to address these issues head-on, including combating arbitrage activities facilitated by banks and Bureau De Change (BDC) operators.

He emphasized that there will be zero tolerance for people not abiding by the regulations, and those who do not comply will face consequences.

In addition, the apex bank would continue to make the market more liquid and to ensure that those who are genuine and want to abide by the rules and regulations that have been set by the central bank will be free to do so, adding that those who do not should be ready to face the consequences.

Cardoso also revealed that the apex bank had paid another $400m out of $2.2bn of valid FX backlog to those who were genuinely identified.

He stated that the bank is committed to clearing the backlog of identified and genuine requests that are pending.

Furthermore, Cardoso reiterated his stance on the suspension of intervention programs and loans by the bank, stating that interventions have two dysfunctions: they take away a lot of time and create distortions in the economy through the inflow of money supply.

The CBN is taking decisive steps to reform Nigeria’s banking sector and address regulatory breaches, while also working to restore public confidence and ensure the stability of the country’s financial landscape.

Subscribe to the Advocate News letter and receive news updates daily in your inbox.

Advocate.ng Latest news update on politics, entertainment, sport and more

Advocate.ng Latest news update on politics, entertainment, sport and more