A new high-tech manicure has been introduced by the technology firm Smart Chip, which allows users to make online payments by simply waving their fingernails at a contactless card machine.

This innovative invention eliminates the need for bank cards, cash, or even a smartphone, as customers can now complete transactions with just their nails.

The £13 device, which holds the user’s bank card details, is connected to a mobile phone app to facilitate payments.

This means that users can shop at supermarkets, dine out at restaurants, or make purchases online without the need for any other payment method.

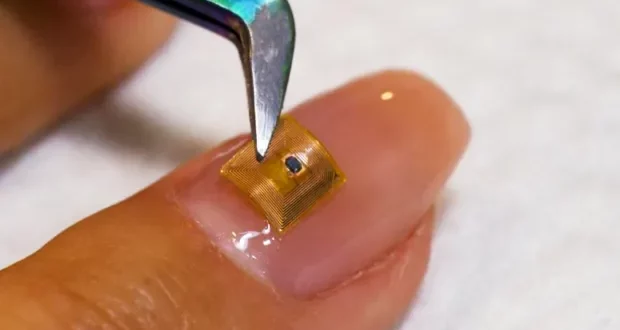

The chip is installed by gluing it to the user’s desired nail and then painting over it with nail polish. If the user already has an artificial nail, the installation cost is reduced to £9.

Smart Chip founder, Rudolph Räber, has emphasized the convenience and security of this technology, stating that the chip “is always with you” and “cannot be stolen” since it is attached to the nail.

However, the chip does need to be replaced every two months, depending on the length of the user’s nails.

The payments are processed by Digiseq, a London-based transactions firm specializing in wearable payment methods.

This collaboration ensures a seamless and secure transaction process for users of the Smart Chip technology.

The introduction of Smart Chip represents a significant advancement in wearable payment technology, offering a convenient and secure alternative to traditional payment methods.

This development is a testament to the continuous efforts of technology experts and researchers to improve daily life through innovative solutions.

Subscribe to the Advocate News letter and receive news updates daily in your inbox.

Advocate.ng Latest news update on politics, entertainment, sport and more

Advocate.ng Latest news update on politics, entertainment, sport and more