The Nigerian Senate has recently passed for a second reading a bill seeking to amend the Central Bank of Nigeria (CBN) Act, 2007.

The bill, which was sponsored by 41 members of the Committee on Banking, Insurance, and other Financial Institutions, aims to strengthen the bank’s ability to maintain monetary and price stability in support of the government’s economic growth objectives.

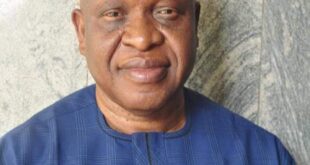

Senator Adetokunbo Abiru (APC-Lagos), the Chairman of the Committee, led the debate on the general principles of the bill.

He highlighted the need for the amendment, citing that the current act has not been updated in over 16 years, despite significant changes to the bank’s balance sheet and challenges in monetary policy implementation.

The proposed amendments are designed to align the CBN’s governance mechanisms with global best practices and to address the lack of coordination between monetary and fiscal policies, which has been detrimental to the Nigerian economy.

The bill introduces a Coordinating Committee for Monetary and Fiscal Policies, which will be responsible for setting targets for both monetary and fiscal policies to control inflation and promote financial conditions conducive to sustainable economic growth.

The committee will consist of the Minister of Finance (who will serve as the Chairman), the Minister of Budget and Economic Planning, the Minister of Industry, Trade, and Investment, the Minister of Agriculture, the Governor of the Central Bank of Nigeria, the Chief Economic Adviser to the President, and the Director General of the Securities and Exchange Commission.

The bill proposes to amend the provision for the appointment of the Governor and Deputy Governors of the Central Bank, providing a single non-renewable six-year term.

This practice, which is in line with the United States Federal Reserve and the European Central Bank, is intended to reduce political influence on monetary policy decisions and address the time inconsistency problem associated with non-independent central banks.

The Senate’s advancement of this bill signals a commitment to improving the effectiveness of monetary and fiscal policies in Nigeria, which could lead to more stable economic growth in the future.

Subscribe to the Advocate News letter and receive news updates daily in your inbox.

Advocate.ng Latest news update on politics, entertainment, sport and more

Advocate.ng Latest news update on politics, entertainment, sport and more