The Federal Inland Revenue Service (FIRS) has decided to postpone the implementation of the Value-Added Tax (VAT) guidelines for digital platforms.

This decision comes as the organization seeks to develop a more seamless process for the effective and efficient collection and remittance of the tax.

The guidelines, which were initially scheduled to be implemented on January 1, 2024, would have affected non-resident suppliers of goods to Nigeria through digital platforms.

The postponement means that these suppliers will not be required to comply with the new guidelines for the time being.

The current regulations for the provision of services and intangibles by non-residents, which went into effect on January 1, 2022, will continue to be in place and are unaffected by this postponement.

Non-resident suppliers of services and intangibles should continue to comply with the provisions of the guidelines concerning the collection and remittance of VAT.

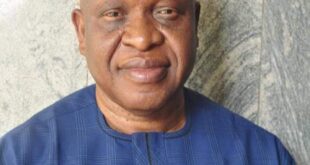

FIRS Executive Chairman Zacch Adedeji emphasized the importance of continuous engagement with stakeholders to ensure a smooth transition and seamless development and implementation of the guidelines.

The organization will continue to work with industry representatives, tax practitioners, and relevant government agencies to ensure the final guidelines are practical, efficient, and meet the needs of all parties involved.

As the FIRS works towards a more streamlined VAT collection process for non-resident suppliers, it remains committed to transparency and fairness in the digital marketplace.

Subscribe to the Advocate News letter and receive news updates daily in your inbox.

Advocate.ng Latest news update on politics, entertainment, sport and more

Advocate.ng Latest news update on politics, entertainment, sport and more